Is Commercial Property a Slow Moving Trainwreck?

Property values and rent worries have a long history. In 301 CE, the Emperor Diocletian issued the Edict of Maximum Prices, which fixed the highest rent chargeable for shops, workshops and warehouses at 50,000 sesterces per year across the Roman Empire. Comparing annual incomes for ancient and modern citizens, suggest this would equate to around £300,000 per year.

Last month, Meta paid £149m to end the lease on its London office as the social media company continues to cut costs. It’s hard not to see this example as emblematic of the structural shift to home or hybrid working, which will also have profound social and economic consequences elsewhere. According to analysts at Jefferies, empty workspace across the UK capital’s West End, City and Canary Wharf business hubs has hit a 30-year high, pressuring shares of several top landlords.

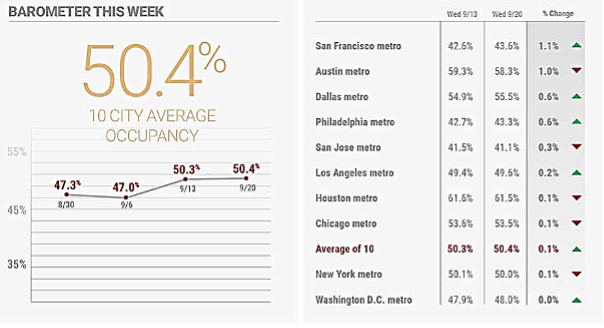

Empty buildings are not just a UK phenomenon, according to Kastle Systems, the average office occupancy rate at the end of September was 50.4% for the top 10 US cities. As property investment and debt go hand in hand, restricted cash flows from these portfolios herald difficult times for real estate companies with large interest payments and the banks who lend to them. Highly leveraged companies, such as the Chinese developer, Evergrande, funded by $300bn of borrowing, have the potential to cause severe financial shocks when they fail.

Source: Kastle Systems

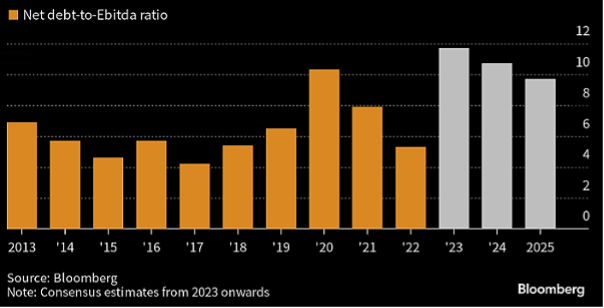

Property stocks are not helped by being the most indebted they have been in 10 years, according to Bloomberg data, which helps to explain why the UK property sector is currently valued at a 25% discount to its underlying asset values. RBC is forecasting a modest 3.5% average growth in UK property sector earnings over the next five years, making their returns look less attractive and more risky than other parts of the investment universe.

Economists across the developed world are growing increasingly concerned about the commercial real estate sector and the wider impact it would have on the financial and investment sectors. Just in the US, the commercial real estate (CRE) industry is $20 trillion.

After decades of thriving growth bolstered by low interest rates and easy credit, commercial real estate has hit a wall as office and retail property valuations have fallen since the pandemic. Lower occupancy rates, changes in where people work, and how they shop are having a huge impact. Government’s efforts to fight inflation by raising interest rates have also hurt the credit-dependent industry.

Banks, especially small and medium sized banks, and regional banks in the US, have a lot of exposure to commercial real estate, which impacts banking stability. This means the stability and health of the commercial property market has an impact on the larger economy, even if you’re not directly interested or invested in commercial property, investors need to stay alert.

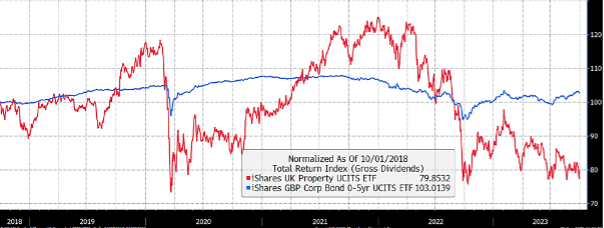

The returns of many of the property funds available for UK investors, either investing directly in properties or indirectly via listed property stocks, have been generally poor over recent years.

Source: Bloomberg LP

Given their mutual sensitivity to interest rate movements, bonds are often compared with real estate, being viewed as a proxy for bond exposure. However, once again, the proxy of bonds seems much more attractive. Over the last 5 years, the iShares Sterling Corporate Bond 0-5 Year ETF, held across most of our portfolios, has outperformed the iShares UK Property ETF by 23%:

Source: Bloomberg LP

At SCM Direct, we currently hold no property ETFs within any of our discretionary Portfolios and the underlying exposure to property stocks is very small. For example, our SCM Long-Term Return and 100% Equity Portfolios hold just 2.5% of their equity exposure in real estate stocks.

Traditionally, a popular rationale for buying a commercial property ETF has been to gain from a rental income that rises in line with inflation, together with a significant yield. However, this has not been the case in recent years for many of the listed property stocks that are only recently recovering from dividend cuts implemented during covid.

Source: Bloomberg LP

Moreover, the trailing 12 month yield of the iShares UK Property ETF of 4.3% compares poorly to the 6.4% Yield to Maturity offered by the iShares Sterling Corporate Bond 0-5 Year ETF.

The SCM Direct investment team remain vigilant but at present we view investing in commercial property as a classic ‘value trap’. True, the property stocks are often trading on large discounts to their reported Net Asset Values. Land Securities is currently on a 37% discount, and British Land on a 47% discount yet these discounts are justified by the very poor outlook. We also believe these property values will remain highly subjective given their reliance on future income streams and occupancy levels, not to mention interest rates. The fact that Meta was willing to pay £149m to exit its lease speaks volumes.

Authors: SCM Investment Team

Comments (0)

To contact us please email enquiries@scmdirect.com.