De-dollarisation, Is the Writing on the Wall?

In this blog, we consider the trend of de-dollarisation and its investment implications.

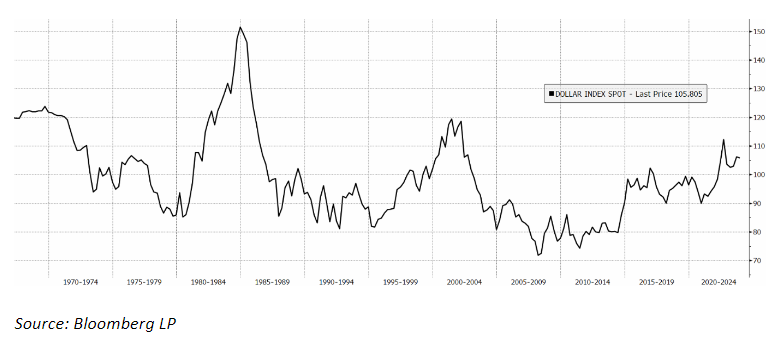

The US dollar remains the world’s leading reserve currency in 2023, but de-dollarisation is set to dominate economic and investment agendas since the BRICS leaders’ summit in late August. Some experts believe that fiat currencies have had their day with several countries increasing their exposure to alternatives to the greenback (fiat money is a government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it). Others are looking to hedge their options. A sudden departure from the status quo seems unlikely—the dollar is too deeply embedded at the heart of the global economy for that to happen—but is the writing on the wall?

Reduced dependence on the US dollar is a key component of the transition to a multi-polar world order where BRICS nations (Brazil, Russia, India, China, and South Africa) are increasingly assertive and divergent from the US-led political, financial, and economic systems forged after World War II.

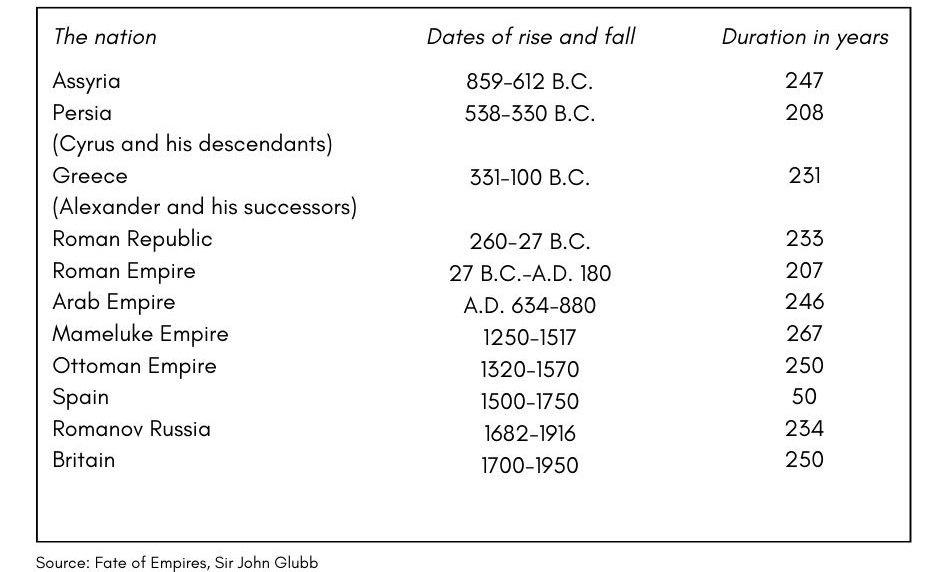

Sir John Glubb, a British General, believed that empires tend to last around 250 years, and his essay ‘Fate of Empires’ has some compelling statistics ranging from the Assyrian to British hegemonies:

Sir John Glubb detailed six consistent phases within each rise and fall equating to a cycle of 10 generations lasting 25 years. These phases are characterised as progressing from ‘the Age of Pioneers to Conquest, Commerce and Affluence to an Age of Intellect’ where cultural achievements peak, before succumbing to a terminal ‘Age of Decadence’.

The USA was officially established on July 4th, 1776, so the Glubb paradigm would suggest somewhere around 2026 as the expiry date of a 250 year old republic. So, is the US dollar on track to be eclipsed as the world’s preeminent currency, suffering a similar fate to the British pound?

Since their first summit in 2009, the BRICs nations have grown to account for almost half the global population and are scheduled to welcome six new members in 2024: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE. The bloc is seen as an alternative to the G7 economic bloc, announcing competing initiatives such as the New Development Bank, the BRICS Contingent Reserve Arrangement, the BRICS payment system, and the BRICS basket reserve currency.

Recent years have seen a rise in countries with bi-lateral trade agreements involving their own national currencies. For example, Brazil and Argentina are paying for Chinese imports using the Yuan, and Russia is settling natural gas sales to China and Turkey in Rubles and Yuan. One of the key drivers has been the use of the Society for Worldwide Interbank Financial Telecommunications (SWIFT) payments system to impose sanctions on Iran in 2015 and on Russia in 2022. During the last BRICS summit in August, the Russian president Vladimir Putin stated that de-dollarisation is an irreversible process which is gathering momentum.

The popularity of gold with central banks is another aspect of de-dollarisation. According to State Street Global Advisors, central banks have been acquiring unprecedented amounts of gold since 2022, diversifying away from an over concentration of reserves in the dollar. They reported that the world’s monetary authorities purchased 387 metric tons in the first half of 2023, having bought a record 1,083 tons in 2022.

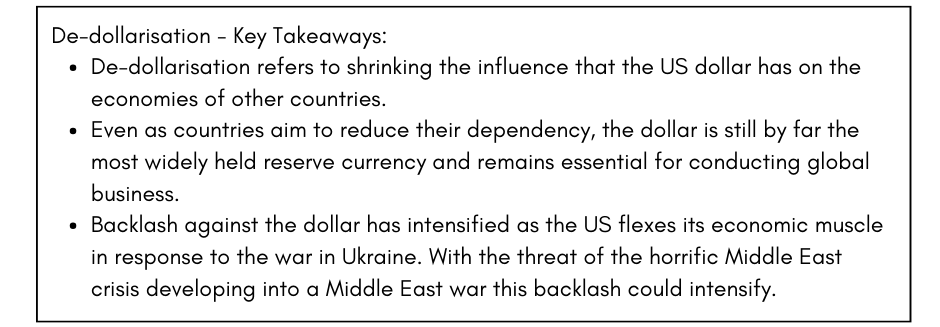

While the proportion of US dollars held within Central Bank reserves has declined from 71% to 59% in 2021, recent dollar performance suggests that capital flows into the world’s largest economy remain robust in these uncertain times.

The chart below shows the benchmark trade-weighted dollar index which measures currency strength against a basket of major currencies. The dollar performed strongly during the Covid period and has also significantly appreciated year to date.

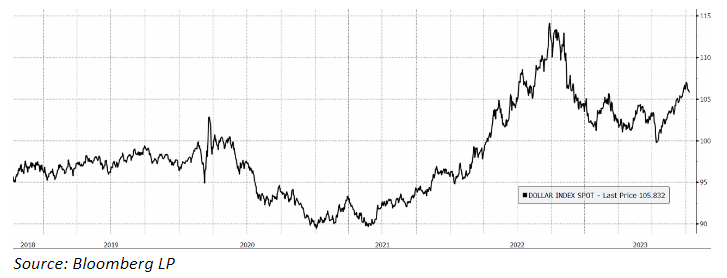

Taking an even longer view on the dollar, suggests that the current valuation is above its 30-year average after a three-decade rally. We can see that major devaluation trends occurred in the mid-80s, after the so-called Plaza Accord which were designed to weaken the currency by mutual consent, and in the post 9/11 era until the Great Financial Crisis of 2008.

Going forward, one critical area to watch is the US-China relationship. China’s holdings of US debt fell to a 14-year-low of US$821.8 billion in July, according to the research firm Capital Economics. However, China remains the second-largest foreign investor in US Treasuries after Japan. As a net buyer of dollar assets, China continues to support the currency of its principal geopolitical adversary – an unusual arrangement reflecting the absence of a viable alternative.

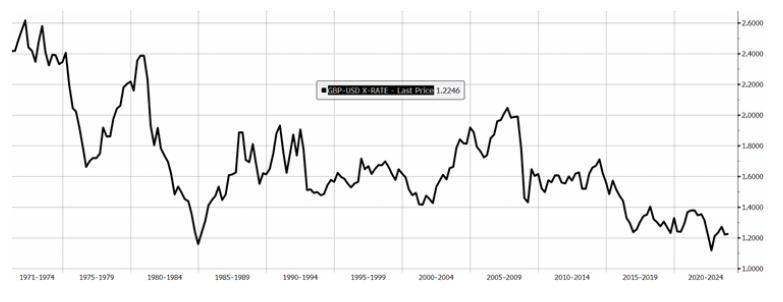

How has Sterling performed against the Dollar?

While the longer-term trend appears to be towards parity with the US dollar, Sterling is trading around its mid-range for the past decade. On the other hand, Sterling’s past could offer a glimpse of a future where the dollar is overtaken by the Chinese Yuan or BRICs equivalent. To date, plans anticipated at the last BRICS summit concerning a gold-backed BRICS cryptocurrency have failed to materialise.

Nevertheless, Central Bank Digital Currencies (CBDCs) are likely to take centre stage in the not too distant future as they offer an extraordinary level of control and transparency for supervision and economic management purposes. Last week, for example, Zimbabwe issued a gold-back digital token for domestic transactions in a nation beset with hyperinflation. The current stance of the US Federal Reserve is that the issuance of their digital dollar would require legislative approval from Congress.

Overall, the US dollar is likely to benefit from safe haven flows from Europe and Asia until a major structural shift occurs which reshapes perceptions of safety and opportunity. One potential catalyst for this could be the tangible prospect of an alternative BRICS currency which has yet to emerge.

On a daily basis, dollar weakness tends to be correlated with higher commodity prices and rising stock market valuations, while a major dollar devaluation would likely result in a season of heightened volatility. As the above charts demonstrate, markets tend to oscillate around specific ranges or move in one direction consistently, offering scope for tactical moves over the short-term as well as strategic positioning for longer duration themes.

From an investment perspective, SCM favours broad diversification across strategies and seeks exposure to a wide range of industry sectors across developed and emerging economies as well as within equity and debt markets. For example, after taking profits earlier this year, our Absolute Return Portfolio retains 29% exposure to emerging markets ETFs spread across three equity and three bonds funds with holdings that cover sovereign debt to small cap companies.

Author: Michael Sawh / SCM Investment Team

Comments (0)

To contact us please email enquiries@scmdirect.com.