The SCM Direct Investment Team made no changes to the allocations during April, a month marked by heightened uncertainty and volatility across financial markets. Persistent inflationary pressures, geopolitical tensions, and evolving central bank policies characterised the challenging environment.

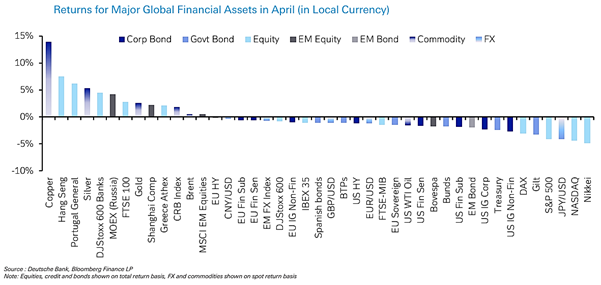

April saw significant losses across several asset classes as the table below illustrates:

Markets started strongly in April, with the S&P 500 hitting an all-time high at the end of March. However, they soon faced setbacks e.g. the ISM manufacturing index indicated expansion for the first time since October 2022, and the prices paid indicator reached its highest level since July 2022. Initially, Fed Chair Powell downplayed these developments, but the accumulating strong data, including a significant rise in non-farm payrolls and a steady increase in core CPI, became too significant to ignore.

US Treasuries experienced their worst month of 2024, with the 10-year Treasury yield recording its biggest daily rise since September 2022. This was largely due to persistent US inflation, raising doubts about the Federal Reserve’s ability to cut rates this year. The US 5-year inflation swap also rose for a fourth consecutive month, up by +10bps to 2.59%, reflecting ongoing market concerns about inflation. Powell’s comments mid-April suggested that achieving confidence in inflation control might take longer than expected, dampening hopes for imminent rate cuts. In Europe, the ECB held its main interest rates steady at 4.00% during its April meeting. Market expectations for rate cuts by year-end adjusted downward, impacting European government bonds, with bunds, OATs, and BTPs all losing ground.

Equity markets also suffered, with the S&P 500 and the small-cap Russell 2000 experiencing significant declines. The STOXX 600 in Europe and emerging market indices like the MSCI EM also faced challenges, though the latter managed a slight gain. The investment landscape was further complicated by ongoing geopolitical tensions, highlighted by a direct attack from Iran on Israel on April 13, which led to market selloffs.

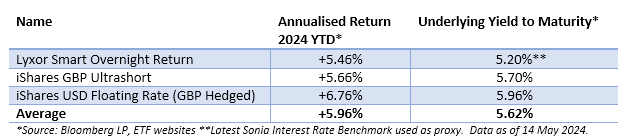

The SCM Direct Investment Team’s steady approach reflects a cautious strategy in navigating these ongoing challenges. Some clients have asked if they can have a quasi-cash portfolio to invest in separately and we have created a simple ETF portfolio, called ‘Liquidity Reserve’ that currently consists of three quasi-cash ETFs at present – an ETF that tracks the overnight index, an ETF that invests in ultrashort maturity corporate bonds, and an ETF that invests in USD floating rate notes (hedged back into Sterling). Please contact us separately if you want further information:

This table shows the three ETFs returns YTD (annualised) – each has produced an annualised net return ahead of the current 5.25% base rate – please note these are the actual ETF returns before the SCM and Hubwise fees and charges.

Alan Miller, Chief Investment Officer, 15 May 2024