Navigating the Investment Landscape: Avoiding Behavioural Biases

By understanding and recognising these biases, investors can make more informed and rational decisions, ultimately enhancing their long-term investment performance.

In the realm of investing, sound decision-making is crucial for achieving long-term financial goals. However, the human mind is susceptible to various biases that can cloud judgment and lead to suboptimal investment choices. Recognising and understanding these biases is essential for navigating the complexities of the market and making informed decisions.

Sun Tzu’s classic treatise ‘The Art of War’ is often quoted by leaders in political and business spheres and, from an investment perspective, one insight is particularly germane: “If you know the enemy and know yourself, you need not fear the result of a hundred battles.’

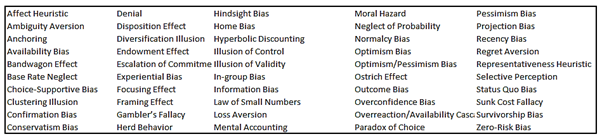

Similarly, consistent investment outcomes rely on awareness of market dynamics to make good decisions and avoidance of individual biases which lead to poor choices. Scanning the literature on behavioural bias yields a multitude of potential pitfalls. The list below contains a sample of 50 common influences on decision-making:

Let’s consider our top 30 red flags to avoid irrational investing followed by in-depth case studies:

- Confirmation Bias – Confirmation bias seeks out or interprets information which confirms an existing belief, with a tendency to ignore contradictory data.

- Overconfidence Bias – Stock-picking fund managers often overestimate their own knowledge and skills.

- Loss Aversion – This causes investors to retain losing investments, often in the hope of breaking even, rather than crystallising a loss.

- Herd Behaviour – Herd-like behaviour is especially a problem in times of market stress when prices are volatile or when a strong consensus leads to an asset bubble.

- Anchoring – Here investors focus on specific prices regardless of current market conditions, for example, the entry point to a position.

- Gambler’s Fallacy – This concerns over-reliance on past events to determine future outcomes. For instance, the probability of a stock price increasing will depend on current market conditions independent of past performance.

- Recency Bias – Recency bias exaggerates the influence of near-term trends persisting into future rather than a longer-term perspective.

- Affect Heuristic – This describes the dominance of emotions and feelings over more objective, fact-based analysis. For example, large market moves can lead to euphoria or anxiety which rarely engender sound investment choices.

- Narrative Fallacy – Here a compelling story which explains historic performance overtakes examination of actual data and current prospects. During the ‘Dot.Com Bubble’ company valuations were inflated by indiscriminate enthusiasm for internet business models.

- Sunk Cost Fallacy – This occurs when investors focus on the amount already invested in a loss-making position as a justification for continued exposure. In reality, future prospects can be unrelated to these historic ‘sunk costs’.

- Regret Aversion – Regret Aversion, or fear of failing investments, can overlook valuable opportunities due to excessive caution.

- Optimism Bias – In this case, investors are unrealistically positive concerning their choices and/or the level of market risk.

- Pessimism Bias – Here excessive negativity exaggerates the downside for investment performance.

- Base Rate Neglect – Base Rate Neglect occurs when investors focus on anecdotal evidence, such as personal observations, rather than publicly available statistics.

- Hyperbolic Discounting – This results an unduly short-term approach to investing by favouring more immediate results which are smaller over longer-term rewards which can be larger.

- Neglect of Probability – In this case, too little emphasis is placed on the probability of an outcome.

- Paradox of Choice – Here investors can suffer from analysis paralysis when faced with too many investment options.

- Projection Bias – Projection bias occurs when an investor expects their current risk appetite and return expectation to persist into the future.

- Representativeness Heuristic – This refers to relying on stereotypes to determine the probability of an outcome. For example, a highly polished presenter of an investment opportunity may unduly influence participation.

- Denial – Simply refusing to accept negative data concerning an investment scenario often leads to poor results.

- Escalation of Commitment – In this scenario, an investor keeps investing more in a loss-making opportunity due to the cumulative investment of resources.

- Illusion of Validity – Here investors over-estimate their ability to make predictions.

- Availability Bias – This describes situations where data is more readily available, rather than an in-depth analysis of information.

- Normalcy Bias – In this case, investors fail to prepare for an extreme event which occurs due to the absence of a recent precedent.

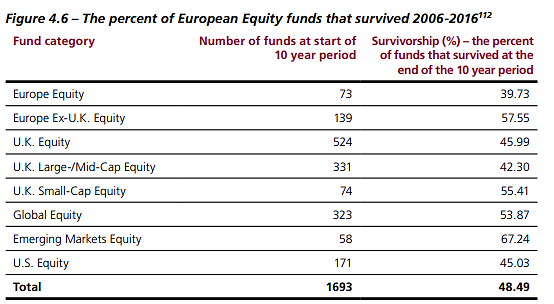

- Survivorship Bias – This refers to scenarios, such performance rankings, where only the winners are analysed, while the losers are excluded. This produces overall results which are skewed to the positive.

- Status Quo Bias – Here investors prefer the current state of a portfolio even though change could be justified.

- Overreaction and Availability Cascade – In this scenario, investors contribute to market volatility through a combination of overreacting to recent news flow and focussing on information which is more readily available.

- Ambiguity Aversion – This is a bias where investors avoid choices with indeterminate probabilities.

- Zero-Risk Bias – Zero-Risk Bias occurs when investors prefer to reduce a small risk to zero rather than a greater reduction within a larger risk.

- Diversification Illusion – This describes a portfolio which appears to well-diversified while being less diversified in reality due to overlapping risk exposures.

Case Studies: Real-World Examples of Behavioural Biases

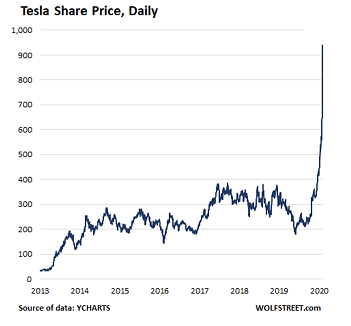

Tesla: Tesla’s meteoric rise has attracted a passionate fan base, leading to confirmation bias among some investors[1] who have focused on Elon Musk’s vision and past successes while ignoring potential risks such as production challenges and financial sustainability. Not to mention competing potential technologies[2] – Toyota, the largest car manufacturer in the world recently said it is close to being able to manufacture next-generation solid-state batteries by 2027 or 2028 which could allow a range of 1,200km and a charging time of 10 minutes.

Bitcoin: The cryptocurrency craze has been fuelled by confirmation bias and herd behaviour. Investors may dismiss concerns about volatility and regulatory uncertainty, focusing instead on the potential for high returns driven by the allure of a new technology. It reached its peak in October 2021 with investors brushing off long standing warnings by regulators – our own regulator, the FCA warned some 8 months earlier[3] that consumers should be prepared to lose all their money if they invest in schemes promising high returns from digital currencies such as bitcoin. A European Central Bank governing council member has made a similar pronouncement.[4]

The hedge fund manager, Bill Ackman’s Valeant Pharmaceuticals Investment: Ackman’s investment in Valeant Pharmaceuticals exemplifies overconfidence bias. He said in November 2015[5] that the drugmaker had been “largely a victim of fear and panic.” and that “The biggest regret I have with Valeant is that we’re not in a position to buy more.” He overestimated his ability to influence the company’s turnaround, leading to substantial losses when the company’s financial troubles came to light. He sold his investment in March 2017 for $300m compared to his total investment of $4.6bn.

Cathie Wood’s Ark Invest: Wood’s high-conviction bets in growth stocks, often referred to as “disruptive technologies,” have been met with both praise and criticism. Some argue that her investment approach is driven by overconfidence. Her fund had rose threefold between March 2020 and March 2021 fuelled by stocks e.g., Tesla and Coinbase. As the chart indicates her confidence was misplaced and her strategy massively underperformed a typical basket of tech stocks – even after her fund had just fallen by 58%, she said, “We have never underperformed the market on a rolling three-year point of view,” and expected a sharp rebound to unfold.[6]

General Electric: General Electric’s long decline from its position as an industrial giant has been partly attributed to loss aversion bias among investors. After the arrival of Jack Welch as CEO in 1981, it diversified through the purchase of RCA and NBC and moved its GE Capital division beyond its industrial financing routes. Issues begun in 2002 onwards as the relative performance chart below shows but were badly exposed in the 2008 credit crunch (its shares fell by 80% from Feb 2007 to March 2009). Shareholders’ reluctance to sell despite the company’s deteriorating fundamentals led to an extended period of underperformance[7].

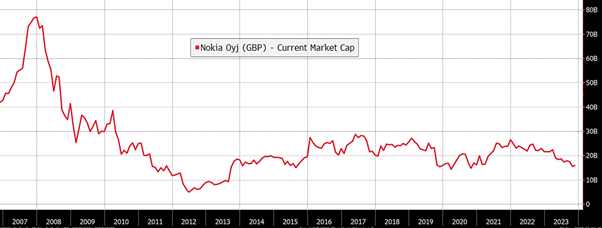

Nokia: Nokia’s fall from grace in the smartphone era exemplifies recency bias. Investors may have held onto Nokia shares based on its past dominance in the mobile phone market, overlooking the rapid rise of Apple and Android smartphones. Its market share had already fallen from a peak of 61% in 2004 to 49% in 2007 when Apple launched its first iPhone. There is a long history in technology of companies and products with commanding market share losing out to new technologies and products – witness the demise of the IBM PC whose peak market share was 80% in 1981 (now 0%) or the BlackBerry market share of 40% in 2008 (now 0%) or the Apple iPad market share of 90% in 2020 (now 32%).

GameStop: The GameStop saga in 2021 was a prime example of herd behaviour and overreaction bias. Retail investors, fuelled by social media chatter and a desire to challenge short sellers, piled into the stock, driving its price to stratospheric levels before it crashed back down. It peaked in January 2021 with much of its rise fuelled by comments by users of Reddit page r/wallstreetbets[8]. The page was started in 2012 but the forum gained momentum during the pandemic. Its members rose from 3m in January 27th 2020 to more than 8 million by the 3rd February.

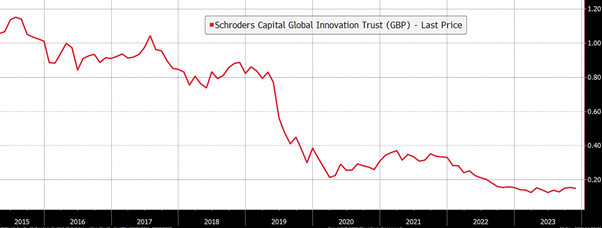

Neil Woodford’s Woodford Patient Capital Trust (now managed by Schroders): The collapse of Woodford’s investment trust in 2019 highlights the dangers of loss aversion and concentration risk. Woodford’s reliance on illiquid assets and his reluctance to sell underperforming positions led to the fund’s suspension and significant losses for investors. The 2017 accounts[9] revealed that 40% was invested in unquoted assets and that more than a third of the fund was invested via just 5 stocks.

It contained a quote from Neil Woodford that ‘that the investment strategy was never designed to deliver significant short-term wins. It remains early days for this strategy, which is seeking to exploit very long-term investment opportunities. Indeed, it is the disconnect between the short-term focus of the modern stock market and the long-term needs of early-stage businesses that in part explains the Company’s performance last year and which has created such a compelling investment opportunity in the first place. WPCT has evolved in 2016, but the original investment hypothesis remains in place. In fact, I believe it is stronger than ever.’

The UK Asset Management Industry: A 2016 report by the Financial Conduct Authority (FCA)[10] found that behavioural biases are prevalent among UK asset managers. It said ‘Behavioural biases may also influence trustees’ decision not to undertake a competitive tender. Trustees may have ‘confirmation biases’ (interpreting new evidence as confirming their existing choices) and are confident that their consultant will be the best provider for them. Others suggested that concern about de-stabilising the relationship with their current consultant can deter trustees from tendering.’

It identified survivorship bias: ‘funds that perform poorly are often liquidated or merged into another fund. Figure 4.6 shows that across all types of equity funds available to UK investors in 2006, only around half have survived in 2016, meaning they were not merged or liquidated). This means that the past performances of all existing funds on the market at any given time do not reflect the performance of funds that have been liquidated or merged. This may give investors the false impression that there are few poorly performing funds on the market. This is known as the ‘survivorship bias’.

Conclusion

These case studies underscore the pervasiveness of behavioural biases in investing and their potential to steer investors astray. By understanding and recognising these biases, investors can make more informed and rational decisions, ultimately enhancing their long-term investment performance.

Authors: Michael Sawh/The SCM Direct Investment Team

Sources:

‘Irrational Exuberance’ by Robert J Shiller

‘Judgment under Uncertainty: Heuristics and Biases’ by Daniel Kahneman & Amos Tversky

‘Thinking, Fast and Slow’ by Daniel Kahneman

‘Misbehaving: The Making of Behavioural Economics’ by Richard Thaler

All graphs sourced from Bloomberg LP unless otherwise stated

[1] https://wolfstreet.com/2020/06/08/teslas-double-wtf-chart-of-the-year/

[2] https://www.ft.com/content/6224f235-568c-4e2f-8247-e7dacf0ef20c

[3] https://www.bbc.co.uk/news/business-55615514

[7] https://www.fool.com/investing/2016/09/14/general-electric-stock-history-will-shares-ever-re.aspx

[8] https://abcnews.go.com/Business/gamestop-timeline-closer-saga-upended-wall-street/story?id=75617315

[10] https://www.fca.org.uk/publications/market-studies/asset-management-market-study#interim

Comments (0)

To contact us please email enquiries@scmdirect.com.